The Governorate of Jendouba, which was registered in 2022 with a population of 404,853 people, is situated in northwest Tunisia at the borders of Algeria.

The food consumption transition in Tunisia is characterized by a decline in cereal consumption and moderation in the consumption of vegetables and fruits. In general, a trend of increasing food intake and westernization of the diet is seen, especially in urban areas towards more consumption of dairy and meat products, sugar, fat and salt.

The stunting levels in Tunisia are generally under 10%, whereas obesity is becoming a big public health challenge. Over the last 20 years, the prevalence of obesity among women has tripled. Half of the women in Tunisia (50.9%) are either overweight or obese. Generally, obesity is more widespread in urban areas.

Except for iodine, which appears not to be an issue for Tunisians, micronutrient deficiency (iron, Vitamin A and D) exists; The dietary intake of these nutrients is below WHO recommendations.

The province of Fernana is strongly oriented toward agricultural production and most of the exploitations are family-run. The most important crop in agricultural production in Tunisia is wheat (almost 48.2% of farmers produce it), followed by olive (42.4% of farmers), barley (32.1%), and fava bean (25.5%).

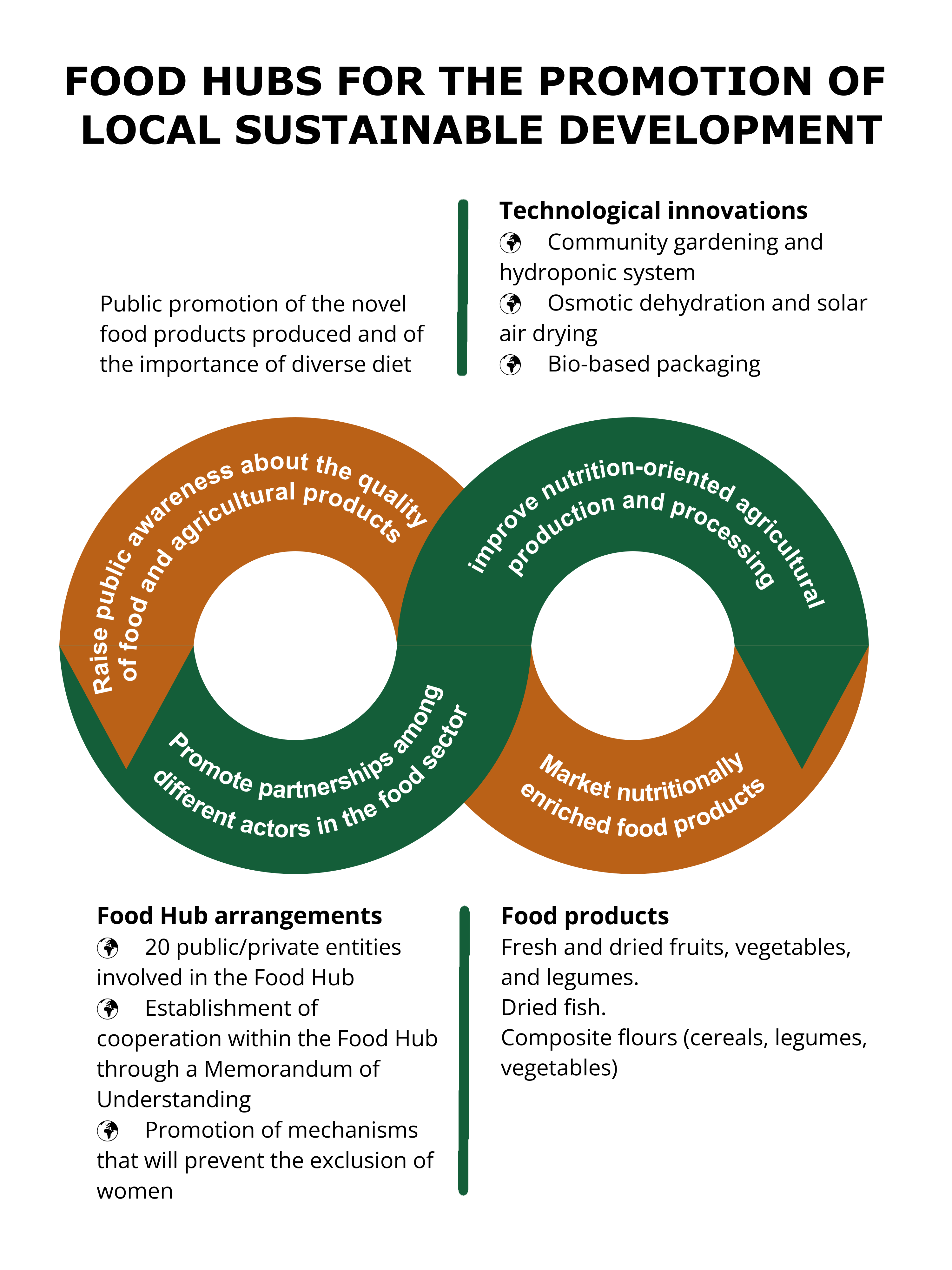

Highlights about the work carried out in this Food Hub

Technological innovations in this Food Hub

Community gardening and hydroponic system. Research and validation will focus mainly on the simplified soilless system as a sustainable, proper, and modern technological approach. Two kinds of hydroponics systems (plastic bottle system and growing substrate bed system) will be realized, and they will include a fed-gravity irrigation system. Such systems will be compared in terms of economic affordability, water uses efficiency and yield. The community gardens will be implemented in primary and secondary schools. This way, children’s and school staff‘s nutritional knowledge will be developed and enhanced by implementing activities on hygiene, alimentation, and common gardens with pupils in order to. This action includes the selection of the most suitable technologies for the local context (micro-irrigation and simplified hydroponic systems), also considering the farmers’ needs, and setting up the protocols for research activities and dissemination to farmers (watch this news item for further details)

Osmotic dehydration and solar air drying. Osmotic dehydration (OD) will be tested as a pre-treatment to drying. However, adding solutes such as sugar or salt might be anti-nutritional due to the high sugar and salt content in the final products. Hence, OD solutes content will be controlled. Convective drying is the most common drying process. However, this technique is very energy-consuming. To improve the efficiency of the drying process, innovative solutions will be introduced, such as Interval starting accessibility drying (ISAD), Interval infra-red accessibility drying (IIRAD). These techniques allow for intensifying the drying process by shortening the effective drying duration and they may also improve the final product quality. Saving energy will be pushed further by using solar energy when running the drying process under any mode.

Bio-based packaging. This action is aimed at developing and testing bio-based packages able to preserve the overall quality of food products from different Food Hubs, during storage and transportation. The activities to be done are the following: identification of different raw materials among several agricultural by-products from local regions to be used as material, optimisation of the coating formulation, assessment, characterization of preliminary obtained materials, pre-selection, testing at lab/small scale level of environmentally friendly, affordable, and suitable pack materials. This Food Hub is focused on bio-based packaging for fresh and dried fruits and vegetables.

Highlights about the research with farmers

FoodLAND surveyed a total amount of 500 farmers in this region with the aim of improving the background knowledge of African smallholder farmers’ decision-making and of individual and contextual conditions. 233 out of these 500 farmers surveyed were women, and the other 267 were men. More than 77% of farmers are not members of any local farmers’ associations.

According to the information gathered from the surveys, 73.8% of farmers’ income is lower than the average income in the region, the income of 18.8% of farmers is about the average or somewhat higher, and only 7.4% of farmers stated an income higher than average. Additionally, 30,8% of them are able to meet their household’s food needs, 30.4% experience some difficulties, and 38.8% face serious food shortages.

Besides, they have reported major worries regarding the near future regarding the cost price increase of fertilizer or seed (4.65 on a scale from 1 to 5), income reduction (4.41), drought (4.17), food shortage starvation (3.98) and health disease (3.81).

With regard to their interest and propensity to introduce new technologies and/or productions, 85.4% of farmers are extremely or moderately interested in adopting a technological innovation (4.4 on a scale from 1 to 5).

Highlights about the research with consumers

With the aim of enlarging background knowledge of African consumers’ food preferences and behaviours and of their socioeconomic drivers and measuring the current level of dietary diversity, FoodLAND has assessed food consumption at both individual and household levels that provide a good measure of diet quality and diversity. FoodLAND has conducted surveys both in households and out of stores in Tunis, which is paired with this Food Hub. 500 people participated in the survey. Below you can find some highlights extracted from these surveys, regarding consumers’ preferences, habits, incentives, and barriers when it comes to choosing food products for their households.

Parallel to the survey instruments, a series of incentivised economic behavioural experiments were developed to gain insights into consumers’ conscious and non-conscious decision-making processes. During the experiments, participants were asked to make decisions on the use of assigned tokens, which were going to influence both their final earnings and the earnings of one or some other participants.

In order to also collect data on rural consumers’ socio-economic conditions and socio-demographics (e.g., migration), food provisioning, preparation and consuming habits and community conditions and services, while paying attention to the gender perspective, a series of surveys with randomized samples of rural consumers have also been conducted in this Food Hub. 500 pairs of women of reproductive age and one of their children between 6 to 23 months of age participated in the survey.

Urban consumers consider on average their household diet as moderately healthy (around 3.5 on a scale of 5). When asked about their propensity to include in their diets a new food product with augmented nutrient content (e.g., naturally improved bean with high levels of proteins and minerals) that could complement their current household diet, consumers report a high level of interest (4.2 on a scale to 5). When looking at the reasons behind the inclusion of new nutrient-dense food, Tunisian consumers rated the highest possibility of enhancing the healthiness of their household diet, their trust in doctor’s recommendations, and affordability. The most rated obstacles are feeling of lower food safety, price, and potential unfamiliar taste.

As for the reasons behind usual food purchasing behaviours, respondents in Tunisia rate the most on average product characteristics (taste, aroma, colour, shape), nutrition content, their willingness to be a good provider and diversify or balance their diet, and food affordability (price). The food categories mostly lacking in the consumer’s household diet are on average vegetables and cereal products.

Consumers were also asked about their interest in buying new local food products. They showed a moderate disposition to buy these local products (around 3.6 on a scale of 5). Among the reasons that make them choose the new local products, the three consumers rated the most were that they could afford it, it could be easily found where they usually buy food, and it could help local farmers.